taxing unrealized gains at death

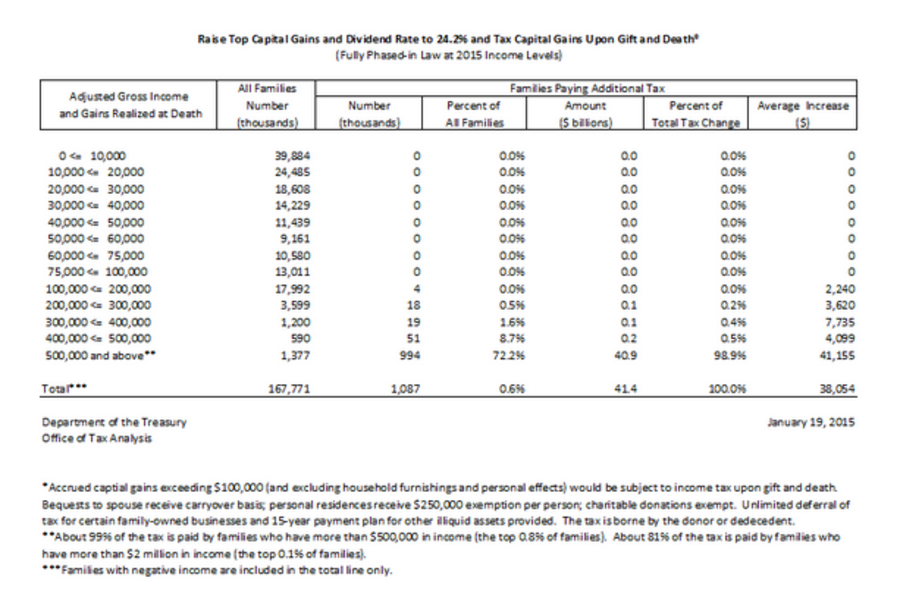

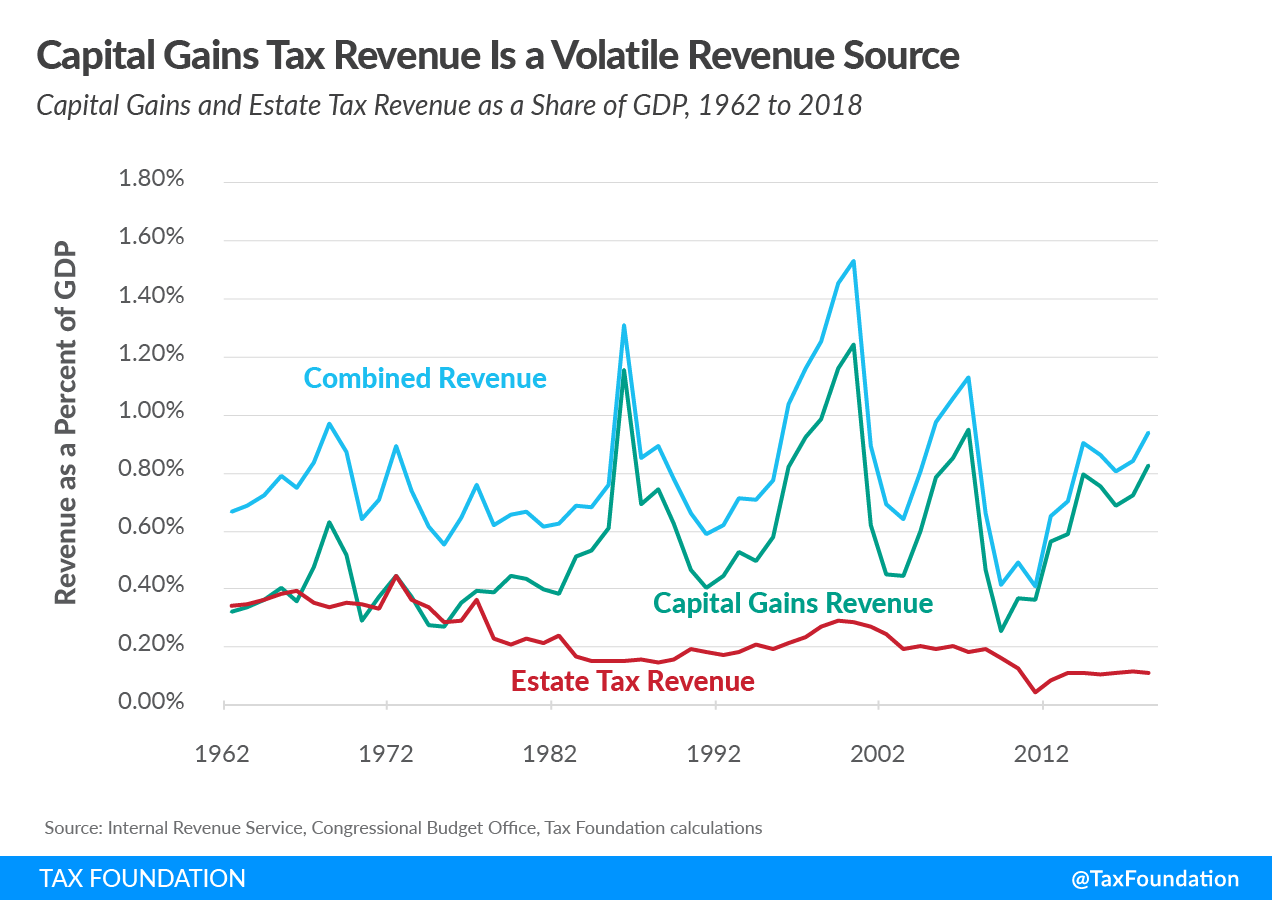

Is expected to lose almost 42 billion in tax revenue this year from the exclusion of capital. In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when.

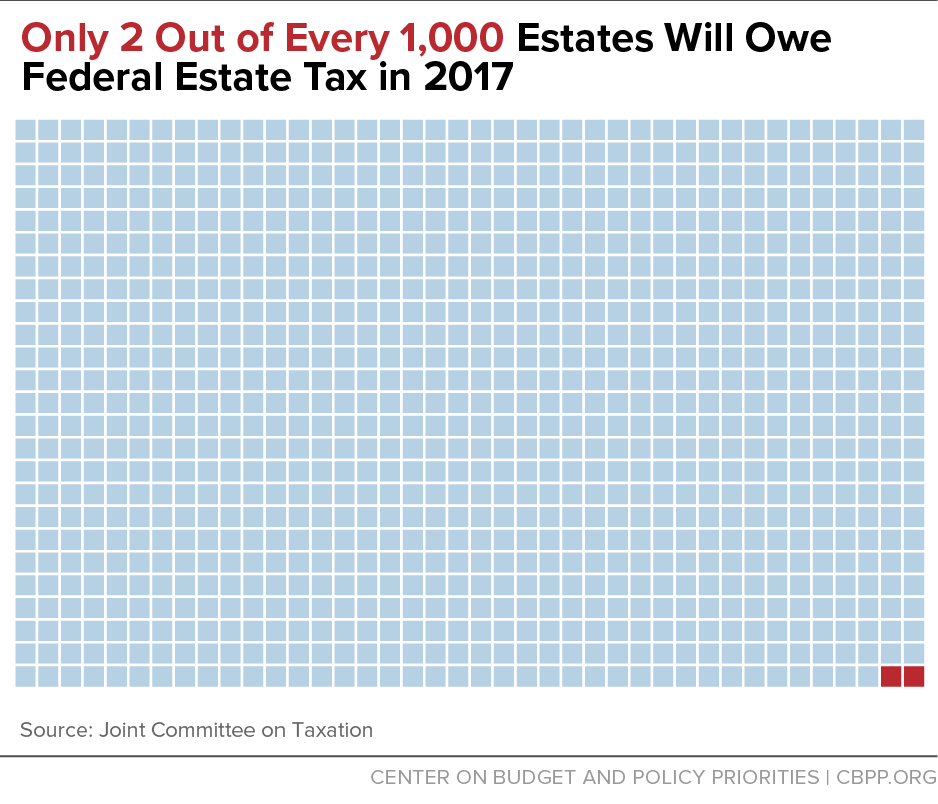

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

The tax proposals now before the House Ways Means Committee do not include Bidens proposal on taxing unrealized capital gains at death which Watson said signals the.

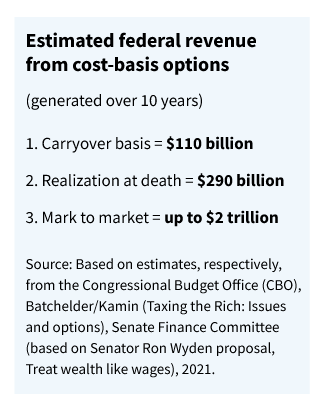

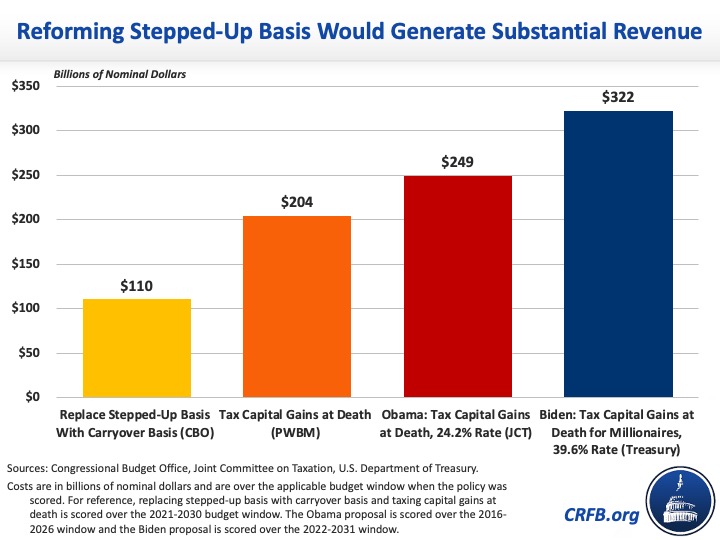

. Similar to todays proposal to tax unrealized gains at death the rules were a great departure from prior law. Lily Batchelder and David Kamin using JCT projections estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in 290. A Crippling Tax for Small Businesses and Middle-Class Families.

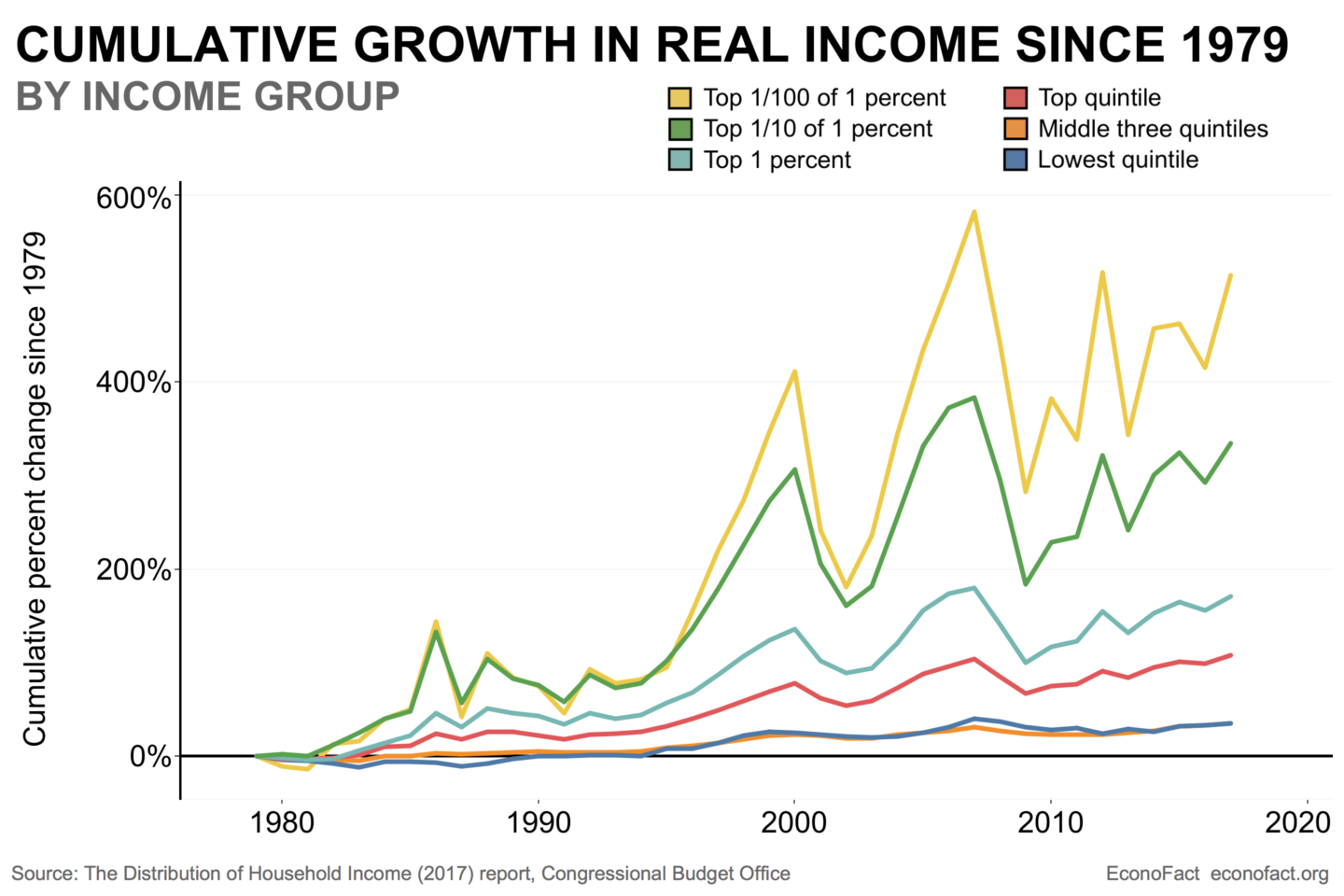

The STEP Act would dramatically change the way capital gains are assessed and taxed on what someone. For example if you were ahead of the curve and bought bitcoin for 100 and. Taxing these gains is important because unrealized gains now account for more than half of the staggering amount of wealth of the very richest Americans those with at least.

When the House Ways and Means Committee produced its components of the Build Back Better Act it omitted a proposal to tax unrealized capital gains at the time of a. Shortly after this article was completed another analysis concerning the Administrations taxing unrealized gains at death was written. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. As tax attorney Robert Hightower argued in 1977 The new carryover. Tax Treatment of Capital Gains at Death When an asset is sold that has appreciated in value such as a share of stock the gain is taxed at rates of 0 15 or.

In addition to taxing unrealized gains at death the AFP would raise the top marginal capital gains tax rate for taxpayers earning over 1 million to 434 percent when. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the. Taxing unrealized gains as they accruewhich Congressional Democrats have said is on the table for Americas billionairesor removing the tax code provision allowing heirs.

The tax would apply to 1 million of that 2 million gain due to the exclusion. In the first scenario which we call no step-up basis all unrealized capital gains in the estate are taxed at death. To fix this longstanding flaw our plan would tax unrealized gains at death for the very rich couples with more than 100 million and singles with more than 50 million at the tax rate for.

3 to two scenarios for applying a capital gains tax at death.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Taxing Capital Gains At Death At A Higher Rate Than During Life Tax Policy Center

Breaking News Unrealized Capital Gains Are Not Taxed Econlib

Death Is No Escape From Taxes Wsj

Three Options To Change Stepped Up Cost Basis Rules

An Overview Of Capital Gains Taxes Tax Foundation

Facts Don T Back Estate Tax Repeal

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

How Biden Would Tax Capital Gains At Death Tax Policy Center

Taxes Dispute Are Accrued Capital Gains Income The Year You Die Csmonitor Com

Democrats Are After Your Money With Wealth Taxes Even A Tax On Unrealized Gains Mish Talk Global Economic Trend Analysis

Closing The Stepped Up Basis Loophole Committee For A Responsible Federal Budget

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

How Biden Would Tax Capital Gains At Death Tax Policy Center